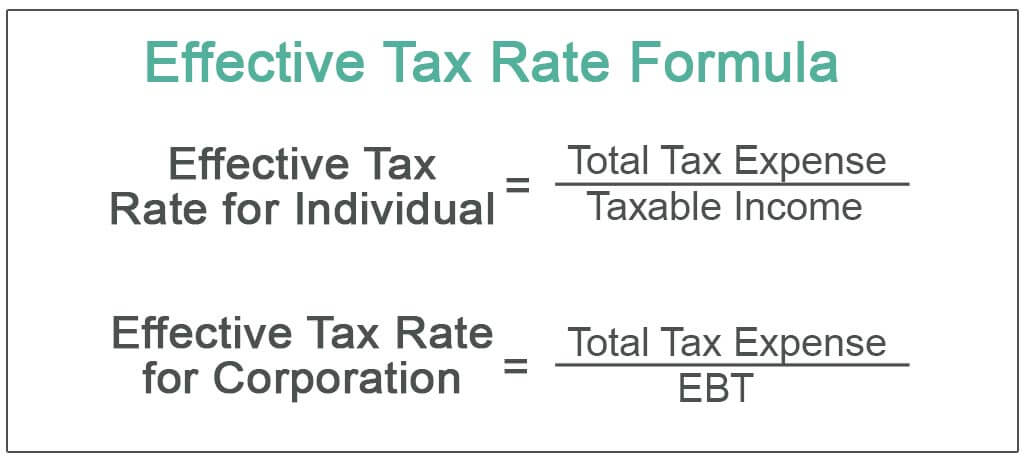

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments, based on a property’s price, current interest rates, and other factors. This can help you figure out if a mortgage fits in your budget, and how much house you can afford comfortably. Most people know that homeownership requires coughing up copious amounts of money. There’s your mortgage, of course, but the costs hardly end there. This means there are higher tax rates for higher income levels. These are called “marginal tax rates," meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

So that means that for every $1,000 of assessed value, $7 is owed in property taxes. The city of Denton has some of the highest total property taxes in the area. When including city, county and school levies, the total rate in the city of Denton is over 2.223%. In Lewisville, the county’s second largest city, the rate is lower at 2.015%. Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owner’s property. The assessed value estimates the reasonable market value for your home.

Denton County

Despite its reputation as a costly place to live, Hawaii has generous homeowners exemptions for primary residents that lower taxable values considerably. The tax break generally helps those who live in Hawaii full-time, rather than those who own a second home there. That taxable value then gets multiplied by the sum of all applicable millage rates. All the separate tax levies are added and then applied to your taxable value. The number you calculate tells you the property taxes owed before any credits. Note that tax credits are different from exemptions and aren’t universally available.

If you’re allowed and choose to pay your taxes yourself, you will pay them in full when they become due. Like we said earlier, some areas allow you to make quarterly or semi-annual payments to decrease the amount you’ll pay at once. Tax credits are only awarded in certain circumstances, however.

Affordability calculator

Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer. The limitations on assessment increases outlined here explain why many assessments take several years to catch up with market value growth or decline. An assessment occurs when an asset's value must be determined for the purpose of taxation. A Mello-Roos is an ad hoc California tax district created with voter approval in order to fund a specific infrastructure project. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Many municipalities apply the tax rate "per mill", or per $1,000 in assessed value. Don't let this confuse you — one mill is just 1/10 of one cent. Ask your local tax office to find out if any discounts are available in your area. Exemptions can lower your tax bill, but you usually have to apply for them.

Property Tax Calculator 2022

While Palm Beach County contains lots of nice real estate, it has some hefty property taxes. Palm Beach County’s average effective property tax rate is 1.06%, which is higher than most Florida counties. The median real estate tax payment is $2,805, also one of the highest.

If the house is an apartment building, you will multiply the land value by the square footage of the apartment building. Tax-Rates.org provides free access to tax rates, calculators, and more. First, a property’s value is assessed via one of the methods described below. Then, the value is multiplied by the assessment rate, which varies by jurisdiction and represents the percentage of a property on which taxes are due. Then, all the levies are added together to determine the total tax rate—what’s called a mill rate—for an entire region.

Calculating property taxes is not too difficult, it just needs a few tricks and formulas. If you own a business, you may have to pay a separate business tax based on your business's profit. Business taxes are not assessed yearly but every three years. If you own a second home, you may have to pay a separate second home tax. Real estate taxes are different from property taxes and business taxes.

Non-owner occupied residential properties are condominiums, HDB flats or other residential properties that the owner does not live in ("occupy"). For example, once a budget is passed by your local government, known revenues are subtracted, which leaves the deficit to be raised through property taxes. This amount is divided by the value of all property in the town, which is then multiplied by 1,000. The mill rate for your property is determined by who or what is taxing you.

For example, property tax is not always lower for a condo than a house. Calculating how much you owe to hourly employees on their final paycheck is quite simple. You just multiply their hourly rate by the number of hours they worked before leaving your company, plus overtime pay. Note that many jurisdictions offer property tax exemptions for certain types of people and organization based on need and occupation.

Property owners are commonly assessed property taxes by more than one government entity, such as a municipality and a county. Texas levies property taxes as a percentage of each home’s appraised value. So, for example, if your total tax rate is 1.5%, and your home value is $100,000, you will owe $1,500 in annual property taxes. Homeowners in Orange County pay a median annual property tax bill of $2,073 annually in property taxes. In Orlando, Orange County’s largest city, the millage rate varies from about 18.5 and up to more than 19.7 mills depending on where in the city you reside. You can find out how much your property tax is based on the current tax rates and the assessed value of your property.

However, this tax payment is divided in half between the employer and the employee. - We regularly check for any updates to the latest tax rates and regulations. The numbers above are only an estimate of the tax you will owe if the tax rate remains the same. You can find the millage rate for an individual property on the property deed itself or by calling your municipal tax office.

Quebec City’s property tax or “Welcome Tax” is based on the assessed value of the home; properties in Quebec are assessed by their regional county municipality or municipalité régionale de comté every three years. Montreal’s property tax or “Welcome Tax” is based on the assessed value of the home; properties in Montreal are assessed by their regional county municipality or municipalité régionale de comté every three years. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county's effective property tax rate.

Calculating Property Taxes

This means they have the first claim to the proceeds when you sell the home unless you settled the lien before you sold the home. Note that there are no longer personal exemptions at the federal level. Prior to 2018, taxpayers could claim a personal exemption, which lowered taxable income. The tax plan signed in late 2017 eliminated the personal exemption, though. Annual property tax is calculated by multiplying theAnnual Value of the property with the Property Tax Rates that apply to you.

No comments:

Post a Comment